All Categories

Featured

Table of Contents

[/image][=video]

[/video]

If you wish to become your own financial institution, you have actually come to the right area. Initially, do you understand how financial institutions take care of to be the wealthiest institutions in the world? Allow's state you deposit $10,000 in the interest-bearing account. Do you assume the financial institution is going to rest on that cash? The financial institution is mosting likely to take your down payment and lend it bent on an individual who needs a brand-new automobile or house.

Did you recognize that financial institutions make between 500% and 1800% greater than you? If the financial institutions can primarily relocate money and earn rate of interest that method, would not you such as to do the exact same? We would certainly! . We've produced our personal banking system, and we're greater than pleased to reveal you just how to do the same.

Nelson Nash was dealing with high rate of interest on business small business loan, yet he effectively removed them and started showing others just how to do the exact same. One of our favored quotes from him is: "The very initial principle that should be understood is that you fund everything you buyyou either pay rate of interest to somebody else or you surrender the passion you can have earned otherwise." Prior to we describe this process, we intend to make certain you comprehend that this is not a sprint; it's a marathon.

Infinite Banking System

A whole life insurance policy plan is a type of irreversible life insurance coverage, as it offers life insurance coverage as long as you pay the costs. So, the very first distinction contrasted to term insurance coverage is the period. That's not all. An additional distinction between term insurance coverage and whole life is the cash worth.

As we saw, in the traditional banking system, you have a cost savings account where you transfer your cash, which will gain interest. The trouble is, we don't get wealthierthe banks do. Because we want to copy the process of conventional banking, we need an interest-bearing account that is self-reliant.

You purchase the entire life insurance policy from the insurance provider similarly that you would any various other plan. Remember that it will certainly require a medical examination. Also if you have some wellness issues, don't stress. It is feasible to acquire a policy on somebody near you to work as your very own bank.

Non Direct Recognition Life Insurance Companies

As you most likely recognize, insurance policies have regular monthly costs you need to cover. Given that we desire to use the whole life plan for personal funds, we have to treat it differently.

To put it simply, these overfunding repayments come to be quickly easily accessible inside your personal family members financial institution. The of this extra payment is spent on a tiny section of added irreversible death benefits (called a Paid-Up Addition or PUA). What's terrific is that PUAs will certainly no more call for superior settlements because it has actually been contractually paid up with this one-time repayment.

Your money well worth is raised by these Paid-Up Additions, which contractually begin to raise at a (even if no rewards were ever paid once again). The reasoning is the exact same as in traditional financial. Financial institutions require our money in interest-bearing accounts to obtain affluent, and we need our money in our savings accounts on steroids (entire life insurance policy plan) to begin our personal financial method and obtain rich.

We wish to mimic that. So, when your cash money value has actually accumulated, it's time to start utilizing it. And below is the part of this process that requires imagination. There are 4 various methods to utilize your plan, but in this article, we will certainly cover just borrowing. You should not transform on the red light even if you saw words loaning.

You don't have to wait for approval or fret about rejection.: When you take financings, none of your cash money worth ever leaves your whole life insurance policy policy! Your total cash value equilibrium, consisting of the sum you obtained, keeps raising. The next action in the procedure of becoming your very own lender is to repay the plan financing.

Infinite Banking Review

Policy financings do not show up on credit scores records due to the fact that they are an exclusive agreement between you and the insurance policy firm. There's even much more. You have. You schedule when you pay rate of interest and principles. You can make interest-only settlements. You don't need to pay anything until you can make a balloon repayment for the complete sum.

No other organization provides this degree of freedom to function as your own bank. You can intend some type of persisting finance maintenance, however the insurance agents do not require it. We did say that this is a four-step guide, yet there is one added step that we want to state.

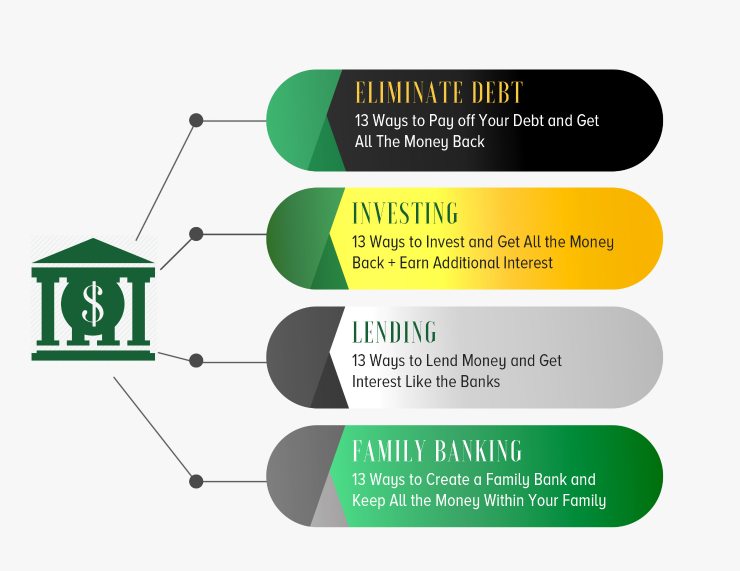

There are infinite possibilities for just how you can utilize your own financial institution. If you still have some uncertainties, allow's see the difference between your personal financial institution and a typical one.

You have the versatility and power to establish your very own regulations. You will certainly eliminate any type of financial obligation you may have now. You will never ever have to pay passion, high costs, or penalties to anyone. You will build riches for your inheritors. Financial liberty. You can utilize your family financial institution for covering any kind of cost.

Limitless financial is the only method to really fund your lifestyle the method you want it. Is there anything else that you would certainly need to be your very own financial institution?

Think of a globe where individuals have no control over their lives and are constrained to systems that leave them powerless. Image a world without self-sovereignty the capability to take control of one's financial resources and fate. This was our globe before blockchain technology and cryptocurrencies. The good news is, brand-new types of possessions like cryptocurrencies are freeing people from the constraints of standard currencies and permitting them to become self-sovereign and independent.

Infinite Banking Illustration

The concept of self-sovereignty empowers people to make their very own decisions without undergoing the control of powerful central authorities. This idea has actually been around for fairly some time. Self-sovereignty indicates that every person has the power and liberty to make their own choices without being regulated by others.

When you put your money in a financial institution, you partly lose control of it. It becomes the bank's money to do as they see in shape, and only a section is guaranteed.

These budgets offer you single accessibility to your funds, which are protected by an exclusive trick only you can control. Non-custodial cool budgets are safer as there is no central database for hackers to burglarize and steal your private trick. You can likewise access your cash anytime, no matter what happens to the company that made the purse.

If it declares bankruptcy, you could shed your coins with little hope of obtaining them back. Nonetheless, if you make use of a non-custodial wallet and keep your private crucial safe, this can not happen. Your cash is stored on the blockchain, and you keep the exclusive secrets. Discover more regarding why you shouldn't keep your possessions on exchanges.

Cash Flow Banking, Infinite Banking, Becoming Your Own ...

If you store it in a non-custodial budget, there is no risk of a bank run or a hacking strike. Withdrawals from a wallet are also easier and more secure. There is less opportunity of anyone forcing the purse owner to do anything they don't wish to do. The wallet owner can withdraw their funds without having to ask for authorization.

Latest Posts

Can Defi Allow You To Be Your Own Bank? - Unchained Crypto

How To Be Your Own Bank - Simply Explained - Chris Naugle

'Be Your Own Bank' Mantra More Relevant Than Ever